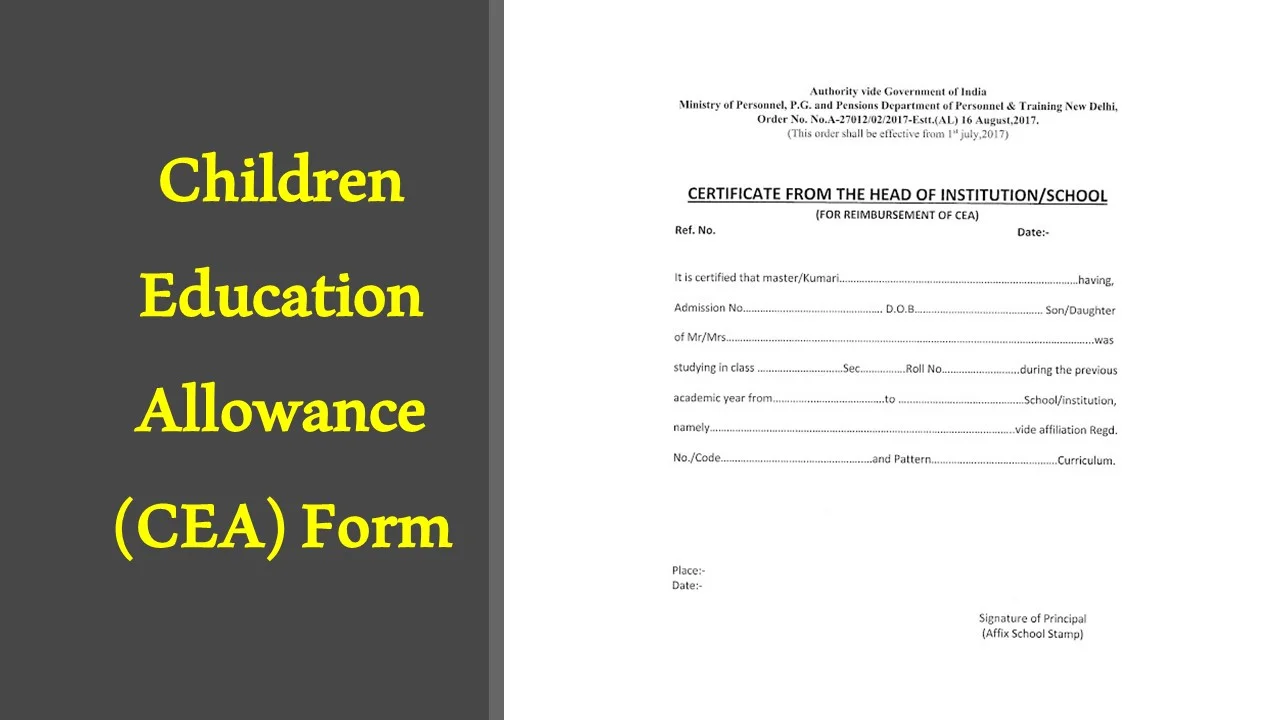

The Children Education Allowance (CEA) Form is an employee benefit for the education of children, given by government departments, public sector units, and some private companies. The employees need to fill out the Children Education Allowance form to claim the tuition fees, uniforms, books, and other educational expenses spent for one’s children in a particular financial year.

The present guide will simply explain all about the Children Education Allowance form so you can fill it up without an ounce of stress and get your claim approved.

What Is the Children’s Education Allowance?

Children’s Education Allowance is a monthly allowance given to eligible employees to enable them to send their children to school. This allowance covers:

- Academic fees

- Books and stationery

- Uniform expense

- Special education needs.

In the Seventh Pay Commission established in India, the children are considered for claiming a maximum of ₹2,250 per month for an employee. This limit is applicable for a maximum of two children and is double for those with disabilities.

Eligibility for Children’s Education Allowance

The application for the Children’s Education Allowance is conditioned upon fulfillment of the following rules:

- Employee status – You must be a regular employee of the organization providing the benefit.

- Number of children – Allowance can be claimed for a maximum of two children only.

- Recognized school – Your child has to be studying in a school approved by the educational boards.

- Classes covered – From Nursery to Class 12.

- Valid proof – Receipts and certificates from the school are required.

Documents Needed for the Children’s Education Allowance Form

While filling the form for Children’s Education Allowance, several documents need to be attached with it, which, when missed, cause frequent delays. Have these ready:

- Duly filled CEA application with all the details

- Fee receipts from the school were availed for the period claimed

- Attendance/study certificate from the school

- Birth certificate of the child or other proof of relationship

- Disability certificate in case of special allowance application.

How to Fill the Children’s Education Allowance Form – Step by Step

It is easy to fill up the Children Education Allowance form if one follows the following steps:

- Obtain the Official Form

Download the latest Children Education Allowance form from the department website or collect it from HR.

- Fill in Your Details

Provide your name, employee ID, designation, department, and office address. Ensure that they correspond with the official records.

- Include Child’s Details

Enter the child’s name, date of birth, class, name of the school, and academic year. Enter one row for each child separately.

- Specify the Period for the Claim

Indicate the months or academic year for which you are making the claim.

- State the Expenditures

Write down tuition fees, books, uniforms, and any other expenses allowable. Attach all bills in evidence.

- Sign the Declaration

You shall sign that the details provided by you are correct, and the school is duly recognized.

- Submit the Form

Present the duly filled-up Children Education Allowance form to HR or the officer concerned before the deadline.

Sample Children’s Education Allowance Form Format

Your organization’s format may differ, but here’s a common example:

Employee Details:

- Name: __________________

- Employee ID: ______________

- Designation: ______________

- Department: _______________

- Office Address: ____________

Child Details:

| Child Name | Date of Birth | Class | School Name | Academic Year | Fee Amount |

Declaration:

I confirm that the above information is correct, and my child is studying in a recognized school.

Signature: ______________ Date: __________

When to Submit the Children’s Education Allowance Form

- Most offices require provisions for submissions of the Children’s Education Allowance form once every year.

- Few offices used to accept claims every half-yearly period.

- Late submissions are likely to be rejected unless they are backed by a valid reason.

- Always keep checking with HR circulars for the final deadlines.

Special Allowance for Children with Disabilities

The last allowance is doubled for special needs children. So, instead of ₹2,250, you can now claim ₹4,500 monthly for them.

Requirements:

- A recognized medical authority must have issued a disability certificate.

- Proof of attendance in a special school or an inclusive mainstream school must be available.

Common Mistakes to Avoid in the Children’s Education Allowance Form

It is small errors when filling out the Children’s Education Allowance form that often lead to rejection. Therefore, avoid the following mistakes:

- Check for receipts/certificates not attached.

- Claiming more than two children.

- Receipts from unrecognized or non-approved schools.

- Instead of reducing eligible expenses, they might add non-eligible ones.

- Forgotten signature/on the date.

Tips to Get Your Children’s Education Allowance Claim Approved Quickly

- Have photocopies of the forms and receipts always.

- Use to make claims well ahead of time.

- Ensure school recognition.

- Write neatly if filling in manually.

- Check all amounts and dates against each other before submission.

Why the Children’s Education Allowance Is Important

The Children’s Education Allowance supports families with school expenditures. It alleviates financial stress and fosters parental investment in quality education. Apply in time, and a sizable amount can be saved every year.

Conclusion

Employees who wish to claim educational expenses for their children must fill out the Children’s Education Allowance form. A little attention to detail on your part regarding filling it out, attaching the correct documents, and sending it in on time will surely make the process very smooth for all concerned.

This benefit supports both your child’s learning and your financial burden. As an employee, it is good to keep all school receipts and submit your claim regularly. Following the correct process allows your child the best education while not placing further stress on your finances.

Also Read: Women Empowerment in Education: Opening Doors to a Brighter Future